Private Hard Money Loans vs. Traditional Bank Loans—What’s The Real Difference?

If you’re exploring real estate investing, rehabbing properties, or expanding your portfolio, chances are you’ve heard the term hard money lending. But how does it actually compare to a traditional bank loan—and when does it make sense?

Welcome to The Peak, our blog series designed to break down private hard money lending in a clear, practical way so you can make informed decisions with confidence. Today, we’re starting with one of the most common questions we hear: hard money loans vs. bank loans—what’s the real difference?

Understanding the Key Difference: Speed Matters

One of the biggest advantages of a private hard money loan is timing.

Traditional bank loans take 30-45 days to close. Between underwriting, appraisals, required inspections, and internal loan committees, deals can either not get approved or take longer than your seller wants to wait.

When you partner with a private hard money lender like Peak Lending, funding can happen as quickly as seven days, with lending decisions made in as little as 48 hours. That speed allows buyers to submit stronger, more attractive offers, especially in competitive markets where sellers prioritize certainty and fast closings.

Cost Isn’t Just About Interest Rates

Bank loans typically come with lower interest rates, but they also bring hidden costs— with the main one being time.

Banks usually require an appraisal, which can cost $400–$700 and add weeks to the process. That delay alone can cost investors opportunities, higher carrying costs, or even the deal itself.

Private hard money loans are more streamlined. There’s no appraisal requirement, which means:

Fewer upfront costs

No scheduling delays

Faster access to capital

For short-term projects, the value of speed and simplicity often outweighs the difference in interest.

Short-Term Loans for Strategic Projects

Hard money loans are designed for short-term use, typically with a 6-month term. That’s very different from a 15-, 20-, or 30-year bank mortgage—and intentionally so.

Because the loan duration is short, the higher interest rate doesn’t accumulate the way it would over decades. When spread across just a few months, the difference is often far less significant than people expect.

This structure makes private hard money loans ideal for:

Fix-and-flip investors

Rehab contractors

Investors stabilizing a property before refinancing

Once a property is repaired, occupied, and generating revenue, traditional banks are often much more willing to step in with long-term financing.

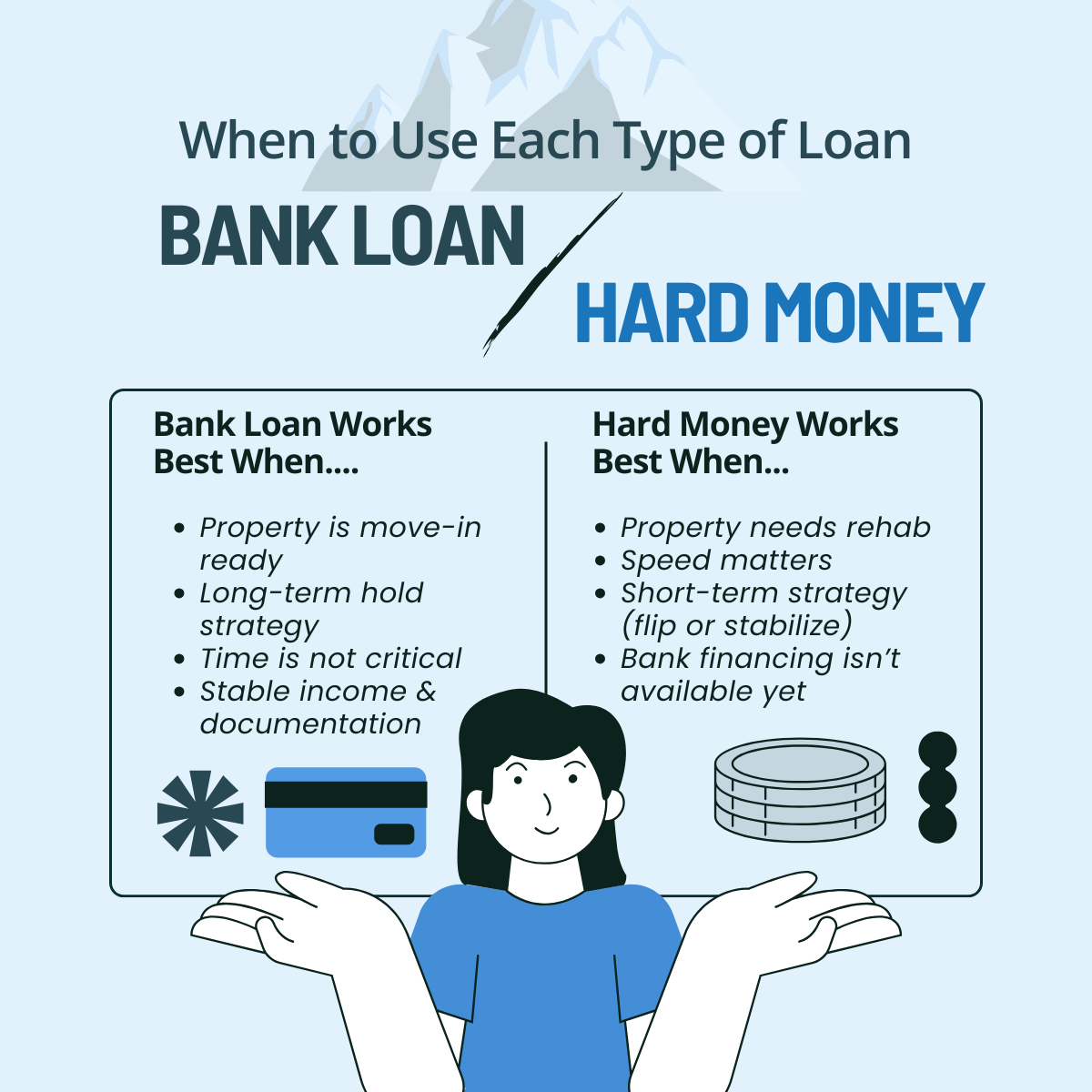

Why Banks Say No—and Where Hard Money Steps In

Banks typically avoid lending on properties that are:

Vacant

In need of major repairs

Experiencing mold, water damage, or structural issues

From a bank’s perspective, these properties represent higher risk.

That’s where we can help. Peak Lending provides funding specifically for businesses purchasing, renovating, and selling investment properties—not owner-occupied homes. We understand the realities of real estate projects and evaluate deals with that context in mind.

Who Benefits from Private Hard Money Loans?

For Real Estate Investors:

Move quickly, compete with cash buyers, and secure deals others can’t.

For Rehab Contractors:

Access funding for improvements without bank delays or restrictive underwriting.

For Portfolio Builders:

Stabilize properties first, then refinance into long-term bank financing once the asset is revenue-producing.

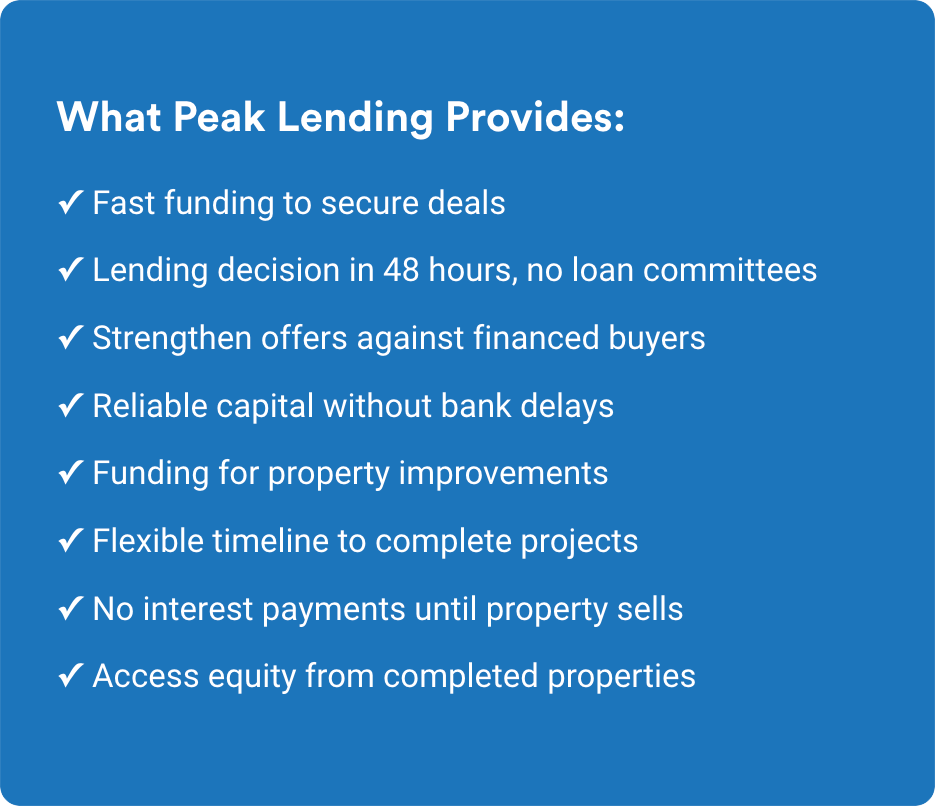

Why Investors Choose Peak Lending

Peak Lending serves Minnesota and Western Wisconsin, offering:

Lending decisions in 48 hours

Funding up to $750,000

Loans covering up to 90% of purchase and rehab costs

No loan committees

Flexible project timelines

No interest payments until the property sells

We’ve flipped properties ourselves, so we understand what investors actually need: speed, reliability, and a dependable funding partner.

Ready to Learn More?

If you’re exploring private hard money lending or wondering if it’s the right fit for your next project, we’re here to help.

👉 Learn more or start the conversation here:

Stay tuned for the next post in The Peak series, where we’ll continue breaking down smart lending strategies for real estate investors.